2020 Economic Impact

Private Equity & the Economic Recovery

The private equity industry and private equity backed companies directly employed more than 11.7 million workers in the United States in 2020 and generated $1.4 trillion of gross domestic product (GDP), or approximately 6.5% of total GDP, according to a new report by EY and the American Investment Council. Additionally, the private equity industry paid $218 billion in federal, state and local taxes last year.

The study outlines private equity’s contributions to the overall U.S. economy, including these details:

- Major employer – The private equity industry in the U.S. directly employed 11.7 million workers in 2020, an increase from the 8.8 million workers the industry employed in 2018. Those workers earned $900 billion in wages and benefits in 2020, up from $600 billion in 2018. That averages out to approximately $73,000-a-year for each worker in the private equity sector last year, or roughly $38 per hour.

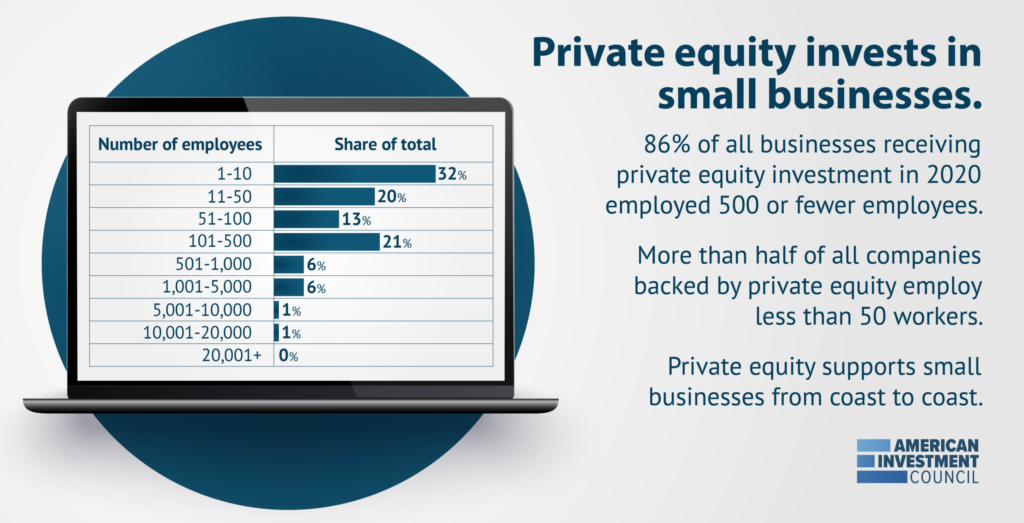

- Small business investor – Private equity continues to invest heavily in small businesses. Of all the businesses receiving private equity investment, 86% employed 500 or fewer workers. Roughly a third employed just 10 workers or less. These small businesses represent the backbone of the American economy, and their strength will be critical to a sustained recovery.

- Tax contribution – The private equity sector in the U.S. paid $218 billion in federal, state and local taxes in 2020, an increase from 2018 when the sector paid $174 billion in taxes. Roughly two-thirds of the 2020 total ($142 billion) was paid to the federal government. Another $76 billion went to state and local governments.

- Multiplier effect – Suppliers to the U.S. private equity sector employed an additional 7.5 million workers across the economy. Those workers earned $500 billion in wages and benefits and generated another $900 billion in GDP in 2020. This activity supported an additional $141 billion in federal, state and local taxes.

- Invested across the country – Private equity invests in communities of all sizes across the country, not just California, New York and Texas. For example, private equity directly employs 229,000 workers in Arizona, 222,000 in Colorado, 110,000 in Nevada and 46,000 in West Virginia.

“This study underscores how private equity helped drive America’s economic recovery from the COVID-19 pandemic and helped small businesses keep their doors open,” said AIC President and CEO Drew Maloney. “These investments helped employ over 11 million workers, rebuild the country’s manufacturing base, and fuel innovation across a wide range of industries. Private equity also pays hundreds of billions of dollars in taxes to help fund programs at all levels of government. We need policies that encourage these investments, not stifle them, so private equity will continue to create growth and opportunities in communities across America.”

Read the Entire EY report: