Research

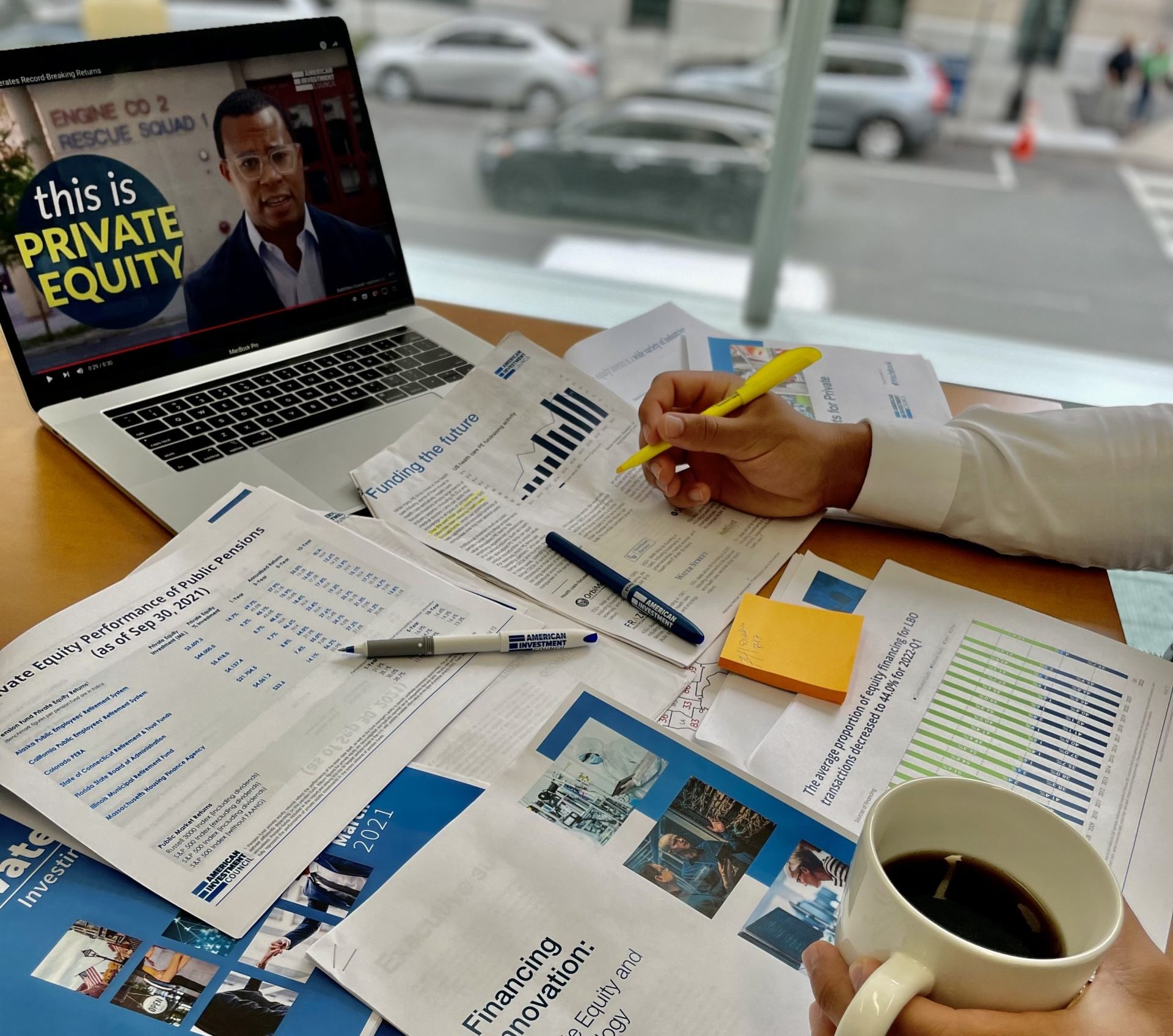

The AIC produces reports that inform readers about private equity investments. We publish quarterly and annual reports that provide current information about investment trends, fund performance, sector-specific investment, and private equity returns to pension funds. The AIC also monitors research by academics and other analysts and have curated a collection of important articles.

Sector Research

Examining how private equity (PE) investments empower workers with competitive wages and benefits, innovative ownership programs, and professional skill development.

Highlighting the growing role of private credit in serving small and middle-market businesses. Examines how private credit provides vital capital and flexible financing solutions for small and middle-market businesses.

Showcasing how private equity investments in critical infrastructure nationwide are improving Americans’ daily lives. The report details the industry’s impact across major sectors of American infrastructure—ranging from construction and engineering to data centers, telecommunications, and energy production.

Showcases how private equity is playing an increasingly important role in the growth and continued strength of the life sciences industry.

Examining private equity’s role in financing American innovation – from scaling promising startups to helping large companies stay competitive in a fast-changing world.

Regular Reports

highlighting private credit’s critical role in growing the U.S. economy, supporting jobs, and providing capital to small and medium-sized businesses across the country.

The report provides new data on the national impact of private equity investments, as well as detailed statistics for all 50 states on jobs, wages and benefits, and GDP.

Highlighting how private equity delivered the strongest returns for public pension portfolios. In 2023, private equity investments delivered a median annualized return of 15.2 percent over a 10-year period.

Analyzes changes in private equity investment each quarter for industrial sectors including business products & services, consumer products & services, information technology, financial services, healthcare, materials & resources, and energy.

Evaluates private equity fund returns each quarter relative to public market indexes, based on publicly available benchmarks and public pension fund returns over multiple time horizons.

Showcasing the investments that private equity firms are making across the country to strengthen local economies and support businesses of all sizes.

Provides an overview of the fundamentals in the private equity each quarter, including investment volume, equity contributions, fundraising, dry powder levels, and exits.

Find academic studies of private equity on the on Other Industry Analyses page.