Private Equity is Improving Health Care

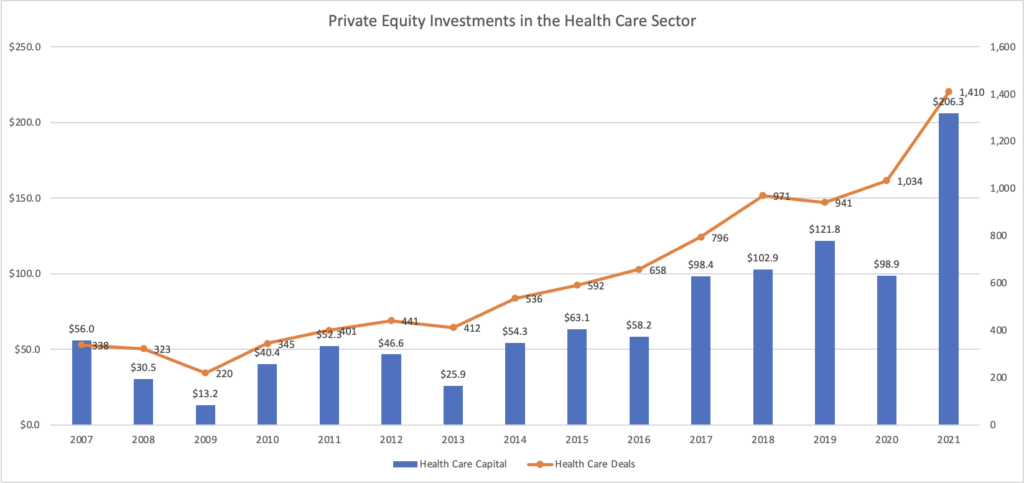

Private equity plays a critical role in supporting quality, affordable health care in the United States. For decades, private equity-funded innovations have delivered more effective treatments and saved lives — and, importantly, helped lower health care costs and increase access to lifesaving care for millions of Americans. According to data compiled by Pitchbook, private equity invested more than $206 billion in U.S. health care throughout 2021 to fund research into deadly diseases like Alzheimer’s and Parkinson’s, expand and renovate facilities, modernize medical records and health care data, and make other needed investments.

In 2021, the Medicare Payment Advisory Commission (MedPAC) released a report reaffirming that private equity investments play an important role providing hospitals, nursing homes, and physician practices with capital and expertise to navigate an increasingly complex health care landscape. The report also described how private equity-backed providers and companies are improving the patient experience by innovating new health care delivery methods. MedPAC did not issue any policy recommendations for Congress to consider regarding private equity.

Increasing Health Care Access by Investing in Urgent Care Centers

Rural America has a profound health care deficit, and much of that problem boils down to a lack of resources: relatively few providers, less insurance coverage, and fewer health care professionals compared to urban and suburban areas. Fortunately, private equity is filling that gap by investing in urgent care providers that have identified business models that work in rural and underserved communities.

- Private equity deals in outpatient clinics such as urgent cares have expanded in the past five years, with more than 250 deals completed in 2020 for more than $15 billion in value. Click here to read the full report.

Investing in Medical Technologies that Improve Lives

By partnering with companies across the life sciences spectrum, private equity is building better businesses — providing financial support and strategic advice to develop innovative technologies and devices that benefit patients and improve lives. The AIC and Pitchbook recently released a new report, “Improving Medical Technologies: Private Equity’s Role in Life Sciences,” that showcases how private equity is playing an increasingly important role in the growth and continued strength of the life sciences industry.

- In the last decade alone, private equity has invested $280 billion across more than 1,800 life sciences and medical device companies in the U.S.

- During the pandemic, private equity continued to support life sciences and medical device companies, investing $36 billion and $55 billion, respectively, into each industry.

- More than 900 medical device and supply companies have been supported by private equity firms in the last 10 years.

Watch & Learn How Private Equity…