ICYMI – Axios: Charted: Tracking PE’s climate dollars

Today, Axios covered a new report from the American Investment Council and PitchBook highlighting how the private equity industry is expanding its clean technology footprint. Private equity investment in clean technology surged to over $27 billion in 2021, hitting a record high.

“The geographically distributed nature of last year’s PE dollars indicates the energy transition is happening country-wide instead of being driven by a handful of first-mover states,” said AIC President & CEO Drew Maloney.

The full story from Axios can be found below.

Axios – Charted: Tracking PE’s climate dollars

By Megan Hernbroth

April 21, 2022

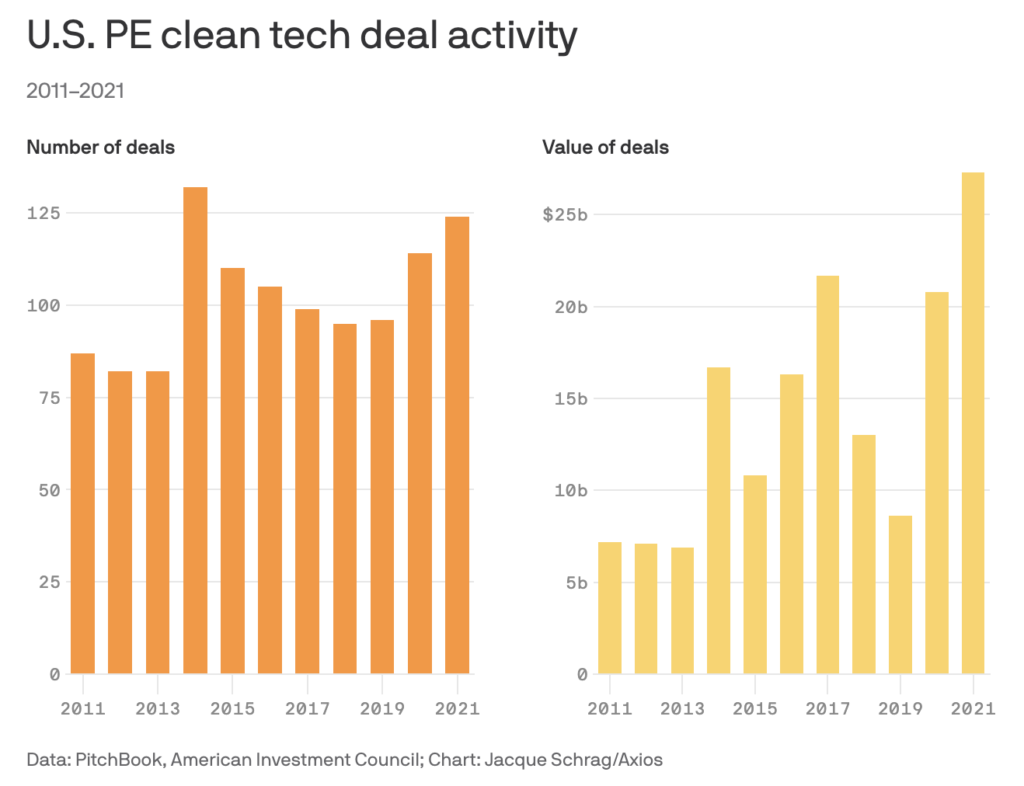

Private equity invested a record-breaking $27 billion-plus in cleantech companies in 2021, according to a new report provided exclusively to Axios from PitchBook and the American Investment Council.

Why it matters: Private equity firms liked the predictability that the Biden administration and the Bipartisan Infrastructure Law brought to the markets, but the true test of private equity’s commitment will come in next year’s report covering the tumultuous 2022.

Details: The American Investment Council, the organization representing private equity on Capitol Hill, teamed up with PitchBook to analyze a decade’s worth of investment in clean technology.

- The report defines clean technology as renewable energy, electric vehicles, waste management, food production, supply chain sustainability and recycling.

By the numbers: Private equity firms invested more than $27 billion in cleantech in 2021 through 124 deals.

- It was a record-breaking year for total amount invested, but the deal volume itself lagged behind the 132 deals made in 2014 in the post-crash renewables market.

- Renewable energy constituted the lion’s share of cleantech deals in 2021, totaling $21.5 billion.

- After falling off in 2018, private equity’s investment in agtech is starting to rebound with $400 million invested in 2021, though nowhere near previous peaks in 2013 and 2017.

- The number of smaller impact funds focused primarily on cleantech also fell from an all-time high of 32 in 2020 to just 13 in 2021, though the amount raised by those firms only dropped a marginal amount.

- Investments were also relatively spread across U.S. regions, with the Mid-Atlantic taking the top number of deals and value of deals for the year.

Between the lines: Private equity is taking on a new role in climate tech as a buyer of mid- and growth-stage venture-backed startups, AIC CEO Drew Maloney tells Axios.

- Smaller PE shops will buy from venture and then turn around and sell the company to a larger PE firm once it’s grown beyond the scale of a smaller firm, Maloney explains.

- “It demonstrates that private equity and capital markets have matured in the last 20 years because you were not seeing that evolution in investments 20 years ago,” Maloney tells Axios.

The bottom line: The geographically distributed nature of last year’s PE dollars indicates the energy transition is happening country-wide instead of being driven by a handful of first-mover states, Maloney says.