ICYMI: Cliffwater Report Confirms Private Equity Overperforms for Public Pension Funds

“Private equity has consistently been one of the strongest performing asset classes within state pension portfolios”

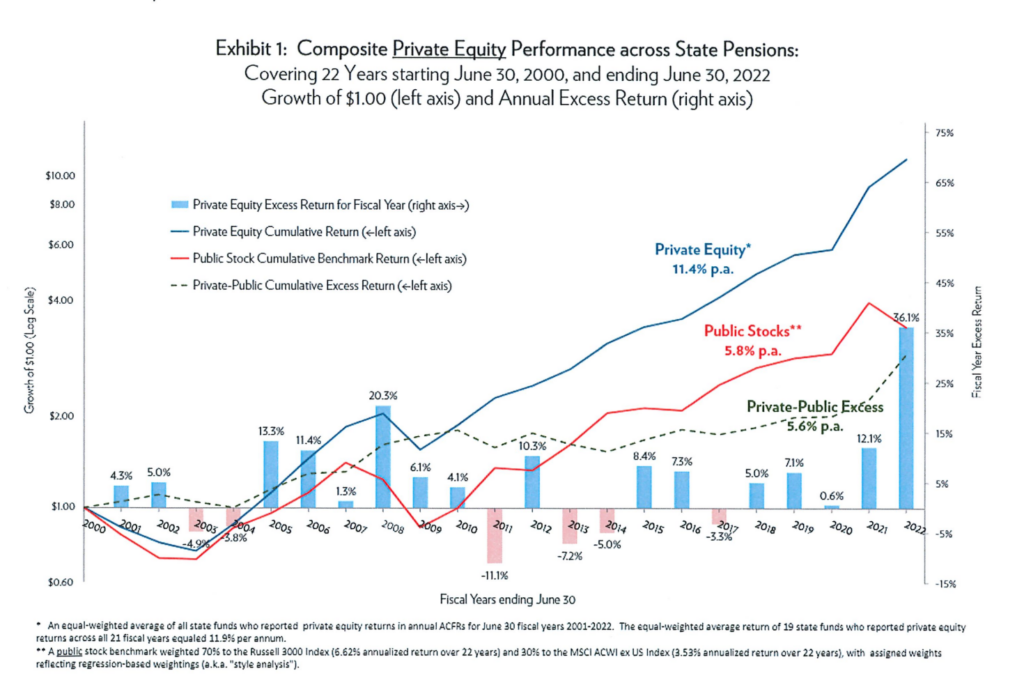

A recent report published by alternative investment adviser and fund manager Cliffwater is the latest research to confirm that private equity delivers the strongest returns for investors across America – helping diversify pensions and strengthen retirements for millions of school teachers, first responders, and other dedicated public servants. The report, which includes data from an annual performance study, found that higher private equity returns did not lead to higher volatility and identified private equity as one of the strongest performing asset classes within state pension portfolios.

The report, titled “Long-Term Private Equity Performance: 2000 to 2022”, has several key findings:

- “Our annual performance study now includes 2022, a year that produced a 21% return for private equity, a record 36% better than the public stock markets”

- “Over a 22-year time period ending June 30, 2022, private equity allocations by state pensions produced a 11.4% net-of-fee annualized return, exceeding by 5.6% the 5.8% annualized return that otherwise would have been earned by investing in public stocks”

- “Not too long ago, a familiar narrative was that private equity returns were failing to deliver the excess return over public stocks compared to years past. Our study finds no such evidence”

- “The study finds that private equity produced a meaningful 5.6% annualized excess return over public equity”

- “Private equity has consistently been one of the strongest performing asset classes within state pension portfolios.”

According to last year’s American Investment Council’s annual public pension report:

- 34 million American public servants depend on private equity to support their retirements

- Private equity delivered a 15% median annualized return over a 10-year period for public pension funds (2021)

- 89% of public pension funds invest in private equity

- 93% of public pension funds plan to increase their private equity allocations.

Read the full Cliffwater report here.