Pension Report

Private Equity Strengthens Pensions

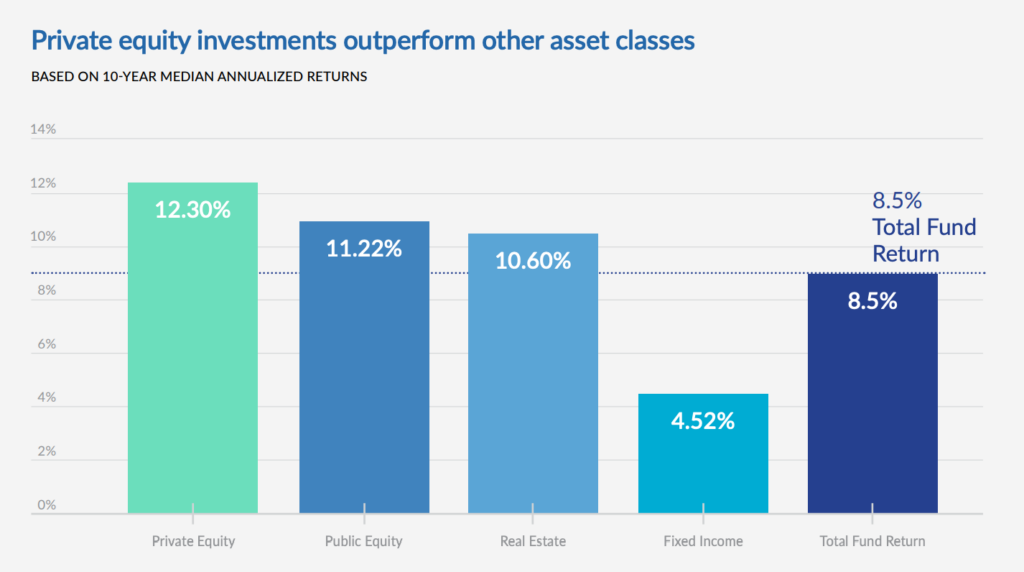

The AIC released the 2021 Public Pension Study. As has been the case each year since its inception, this study found private equity to be the best returning asset class in public pension portfolios. In 2020, private equity continued to provide a strong return on investment, with a median annualized return of 12.3 percent over a 10-year period.

The study analyzed 178 U.S public pension funds which represent nearly 34 million public sector workers and retirees. 85 percent of public pensions in the sample had some exposure to private equity. On a dollar weighted basis, private equity makes up 9 percent of public pension portfolios.

Private equity is partnering with pension funds to help meet their obligations to retired public servants. Private equity works closely with pension funds to help diversify their portfolio and deliver robust returns. In fact, a poll by Preqin found that 53 percent of investors plan to increase their allocations to private equity, 43 percent of investors plan to maintain their private equity valuation and only 4 percent of investors plan to decrease their allocation to private equity.

“The positive impact of private equity can be felt in every state and community across America. Private equity firms are providing critical capital and expertise to grow businesses and support jobs, all while generating impressive returns to help public sector workers enjoy a more secure retirement.”

Drew Maloney, President & CEO, American Investment Council

The top 10 public pension funds by private equity returns:

- Illinois State Board of Investment, which had a 10-year annualized return of 16.10 percent as of June 30, 2020, net of fees.

- West Virginia Investment Management Board, which had a 10-year annualized return of 16.06 percent as of June 30, 2020, net of fees.

- Teachers Retirement Association of Minnesota, which had a 10-year annualized return of 15.90 percent as of June 30, 2020, net of fees.

- Massachusetts Pension Reserves Investment Trust, which had a 10-year annualized return of 15.03 percent as of June 30, 2020, net of fees.

- Ohio School Employees Retirement System, which had a 10-year annualized return of 15.03 percent as of June 30, 2020, net of fees.

- Public School and Education Employee Retirement Systems of Missouri, which had a 10-year annualized return of 14.70 percent as of June 30, 2020, net of fees.

- Iowa Public Employees’ Retirement System, which had a 10-year annualized return of 14.65 percent as of June 30, 2020, net of fees.

- Stanislaus County Employees Retirement Association, which had a 10-year annualized return of 14.30 percent as of June 30, 2020, net of fees.

- Philadelphia Board of Pensions and Retirement, which had a 10-year annualized return of 14.10 percent as of June 30, 2020, net of fees

- San Francisco Employees’ Retirement System, which had a 10-year annualized return of 14.05 percent as of June 30, 2020, net of fees

Read the full 2021 Public Pension Study: