Private Equity Sees Strong Investment in Q3 of 2015

WASHINGTON – Private equity investment increased by 15 percent to $154 billion in the third quarter of this year, according to the most recent Private Equity Growth Capital Council’s (PEGCC)…

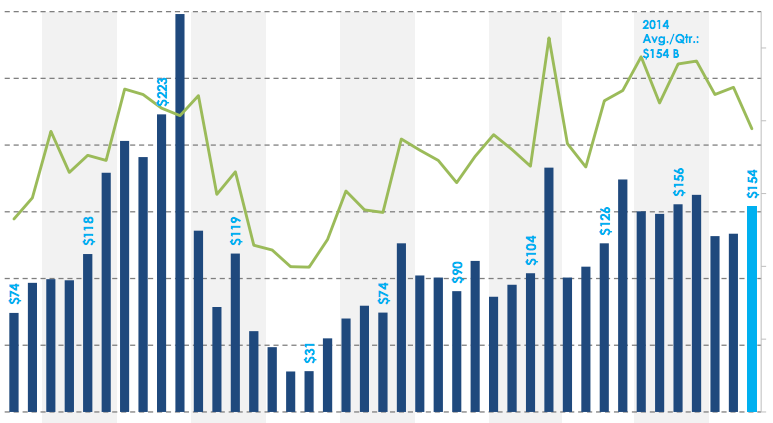

WASHINGTON – Private equity investment increased by 15 percent to $154 billion in the third quarter of this year, according to the most recent Private Equity Growth Capital Council’s (PEGCC) Trends Report. Exit volume declined, but remained at the highest Q3 level in the past decade.

“After a record level of exit volume in the second quarter, we saw a shift in focus away from portfolio exits and toward new investments,” said Bronwyn Bailey, Vice President of Research for the PEGCC. “This increase in investment is significant and suggests that private equity will continue to drive economic growth in companies and markets across the U.S.”

The report also found that:

-Total equity financing for U.S. leveraged buyouts increased to 43 percent in the third quarter.

-Callable capital reserves increased from $448 billion in December 2014 to $486 billion as of the end of September 2015.

-Private equity fundraising volume decreased from $67 billion in the second quarter to $59 billion.

Released each quarter, the PEGCC’s Trends Report provides an analysis of key factors impacting private equity industry activity in the U.S. The full report can be found here.

About the PEGCC Private Equity Trends Report

Designed to provide a snapshot of the private equity market, the quarterly Private Equity Trends Report analyzes key factors that affect U.S. private equity investing. The Private Equity Trends Report provides analysis based on data from PitchBook, Preqin and Standard & Poor’s Leveraged Commentary & Data.