NYT Podcast Paints False Picture of Carried Interest and Private Equity Industry

A recent episode of the New York Times’ podcast “The Daily” mischaracterized the history of the tax treatment of carried interest – which has always appropriately been treated as a capital gain since the inception of the tax code more than 100 years ago. It also presented a false and outdated picture of the private equity industry’s significant contribution to economic growth and job creation.

Carried Interest is Appropriately Treated as a Capital Gain, Encouraging Long-term Investment

- Guest: [The Private Equity Industry] effectively have managed to say that the profits that they get should be taxed at this lower rate at the capital gains rate that has typically been reserved for people who are investing their own money, not their labor. And the private equity firms are saying, look, this money is at risk. It is just like an investment. And so it should be considered an investment. And therefore, we should collect this lower rate . . .

- Host: So this is just not at all how this was supposed to work.

- Guest: Right, and the government, for years and years and years, has let them do this . . . Nobody knew it. Nobody understood what was really happening

The podcast inaccurately claimed that private equity has benefitted from the so-called “carried interest loophole.” However, profit sharing/carried interest has been around for hundreds of years to provide service partners an incentive for the sweat equity they put into growing a business.

What is carried interest? – When a portfolio company succeeds and is sold by a private equity fund, typically four to seven years later, the investors all split the net profit from that investment. The limited partner investors, typically pension funds or university endowments, receive their money back plus a guaranteed rate of return. The remaining profits are then split 80-20, with limited partner investors receiving 80 percent and the private equity general partners receiving 20 percent. That 20 percent is what’s known as carried interest.

Carried interest is rightfully taxed as a capital gain – Just like other investments, carried interest is taxed as a capital gain and has been for more than 100 years. By treating carried interest as a capital gain, the U.S. Tax Code is providing a crucial incentive for private equity and other investors to take risks, make productive long-term investments in businesses, and contribute operational expertise to entrepreneurs. Additionally, Congress made recent changes to carried interest in the 2017 Tax Cuts and Jobs Act requiring investors to invest in capital assets for more than three years before receiving long-term capital gains.

Other sectors employ the carried interest model – Real estate partnerships, venture capital, hedge funds, and emerging diverse fund managers all employ the carried interest model. Listen to Shila Nieves Burney, a general partner at Atlanta-based Zane Venture Fund and Zane Access which invests in diverse entrepreneurs and businesses, “I’m not a billionaire on Wall Street. I don’t come from a wealthy background. This is my sweat equity that I’ve put in.”

Raising taxes on carried interest hurts businesses and retirees – Further raising taxes on these productive private equity investments is bad policy. A recent study from Professor Charles Swenson of the University of Southern California Marshall School of Business found that a proposed 98 percent tax increase on carried interest capital gains would result in millions of lost jobs, billions in lost tax revenue, and would limit returns for U.S. public pension funds.

Private Equity Supports Nearly 12 Million Jobs and More Secure Retirements for More than 30 Million US Pensioners

- Guest: “Well, typically, a private equity firm is trying to buy a company, oftentimes, that’s distressed with debt. They hope to fix it up, in some cases, slash costs, which, oftentimes, means eliminating labor, firing people, and then turning around and trying to sell it at a higher price.”

The podcast painted a misleading and caricatured view of the private equity industry that simply is not true. Private equity investment plays a key role in supporting fast-growing, innovative companies and small businesses creating millions of jobs. Here are the facts.

Job Creation. The private equity industry and PE-backed companies directly employ more than 11.7 million workers in the United states, generated $1.4 trillion of gross domestic product, and paid $218 billion of state, local, and federal taxes. This includes hundreds of billions of dollars in investments in cutting-edge businesses focused on clean-energy, medical breakthroughs, and promising technology businesses.

- A recent study also found that PE-backed IPO companies “on average created more jobs, generated larger revenues, and spent more in capital expenditures than did their non-PE-owned peers after their initial listing.”

Investing in Small Business. In 2021 alone, 74 percent of more than $1 trillion in private equity investments went to support 5,205 businesses with fewer than 500 employees.

Delivering Secure Retirements. Private equity invests on behalf of retirement systems representing more than 34 million workers — and is the best returning asset class in a public pension portfolio, outperforming all others.

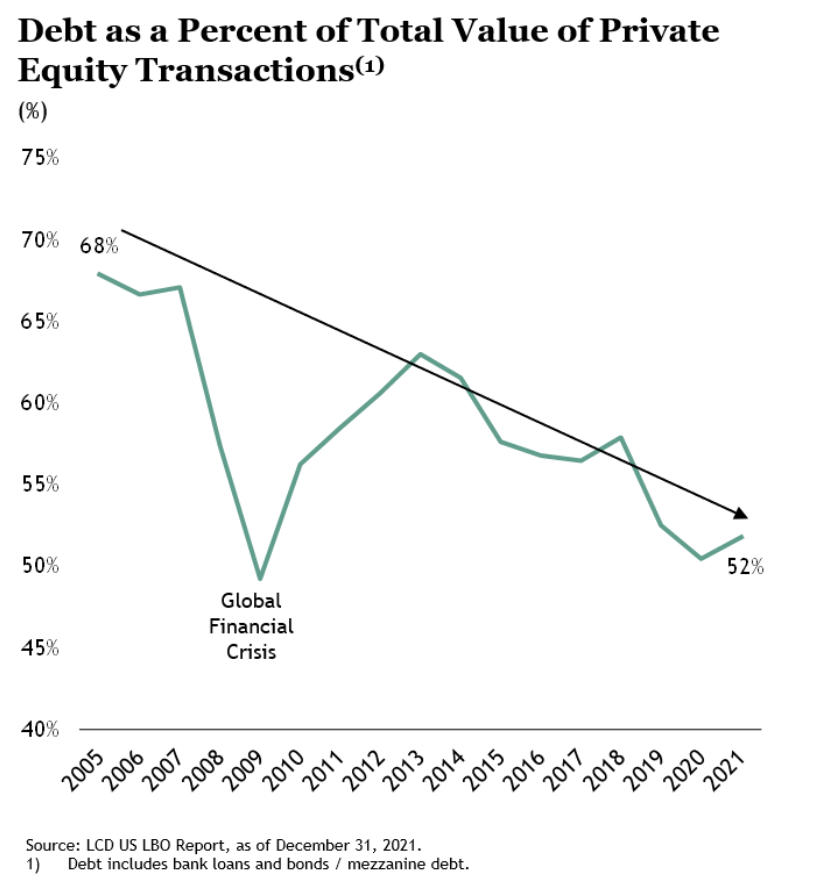

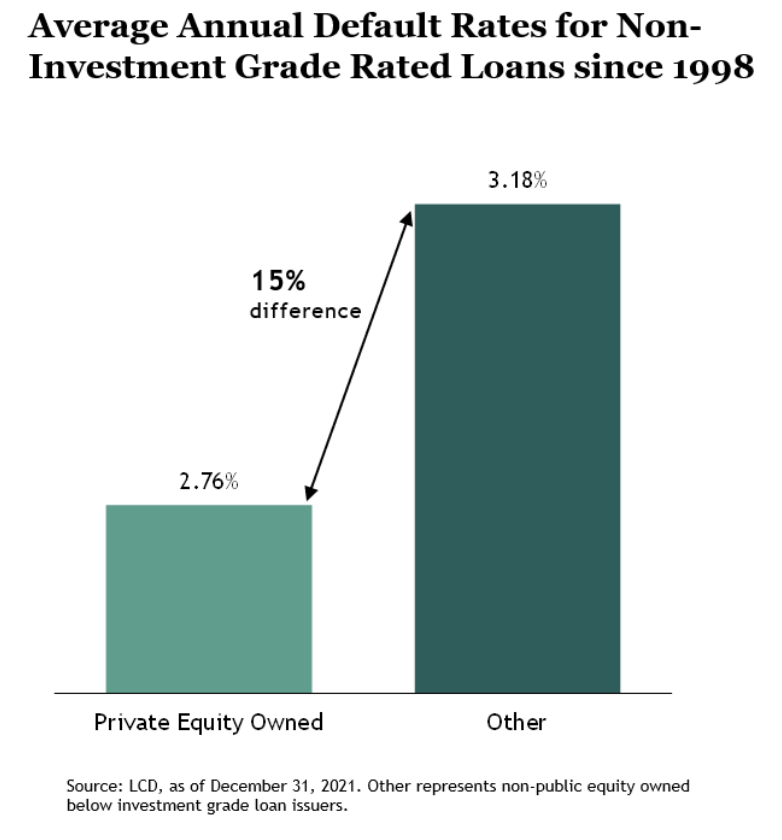

False Claims About Private Equity and Debt. Debt levels at private equity-backed companies have declined significantly in recent years – particularly as the industry has increasingly invested in fast-growing businesses. Private equity owned companies that do borrow funds also default at a far lower rate than other corporate borrowers – undercutting mischaracterizations about how the industry utilizes borrowed capital.