AIC Year in Review: Private Investment Creates Jobs, Expands Opportunity, and Strengthens Retirement Security

WASHINGTON, D.C. – In 2025, private investment played a critical role in sustaining U.S. economic strength by supporting job creation, empowering small businesses, and strengthening retirement security. As the voice of the private equity (PE) and private credit industry, the American Investment Council (AIC) this year highlighted the industry’s significant positive economic impact, educating key audiences, and advocating for meaningful policies that support long-term growth.

Below is an overview of AIC’s key accomplishments in 2025:

Legislative Wins: Ensuring Tax Reform Promotes Private Investment

In 2025, AIC worked extensively to educate lawmakers on the critical role that carried interest plays in promoting long-term, productive private investment, supporting jobs and businesses in communities across the country. In part due to AIC’s efforts, Congress enacted long-term tax reform through the One Big Beautiful Bill Act (OBBA), providing stability and certainty for the tax treatment of carried interest and reinforcing the importance of long-term investment.

Regulatory Wins: Expanding Access to Private Assets for Americans with a 401(k)

In August, President Trump issued an executive order democratizing access to alternative assets for 401(k) investors. The EO paves the way for more Americans to have the choice to invest in and benefit from the strong record of long-term returns of private investments. AIC looks forward to continuing to work with the administration and policymakers in 2026 to support the successful implementation of this executive order.

Strengthening Retirement Security

Throughout the year, AIC continued to raise public awareness of private equity’s role in delivering strong, reliable returns for retirees through research, data, and thought leadership. AIC’s 2025 Pension Study analyzed more than 200 public pension funds nationwide:

- 13.5%: The private equity median annualized return over a 10-year period, higher than all other asset classes including public equity, real estate, and fixed income.

- 34 million: The number of U.S. public sector workers who depend on private equity to secure their retirements.

- 89%: The share of public pension funds nationwide that invest a portion of their portfolio in private equity.

- 94%: The share of institutional investors planning to either increase their allocation or maintain their current allocations to private equity over the long term.

Pension fund leaders underscored the importance of private equity performance:

- “Private Equity has been the highest returning asset class in the Ohio SERS portfolio for the past ten years and longer and has contributed to enhancing the funded ratio and sustainability of our pension fund.” – Farouki Majeed, CIO, School Employees Retirement System (SERS) of Ohio

- “Even with the gains in public equity in recent years, the ten-year returns of private equity are still stronger.” – Jim Herington, Investment Officer, West Virginia Investment Management Board

AIC’s new report, The Persistence of Private Equity, published in early December, further demonstrated that private equity outperforms other asset classes over 5-, 10-, 15-, and 20-year time horizons. In conjunction with the report release, AIC President and CEO Will Dunham authored an op-ed in Fortune highlighting how private equity’s strong returns – combined with expanded access for 401(k) investors – can play a key role in addressing America’s retirement security challenges.

Fueling Small Businesses

Private equity and private credit continue to drive growth in America’s small businesses. More than 85 percent of private investment dollars support businesses with fewer than 500 employees. AIC’s economic contributions report, published in partnership with Ernst & Young LLP (EY), found that the median private equity–backed business employed just 72 workers in 2024, while our private credit report found the median private credit–backed company employed 182 people.

In October, we released a video series featuring Van Leeuwen Ice Cream and Little Sesame, two growing consumer brands that partnered with private equity to expand their reach nationwide. AIC also released a video spotlighting Missouri-based Environmental Dynamics International, a manufacturer of aeration solutions supported by investments from AIC member KKR.

During National Small Business Month in May, AIC launched a high-impact advertising campaign at Ronald Reagan Washington National Airport, emphasizing the essential role of private equity in strengthening American small businesses.

Supporting Workers and Families

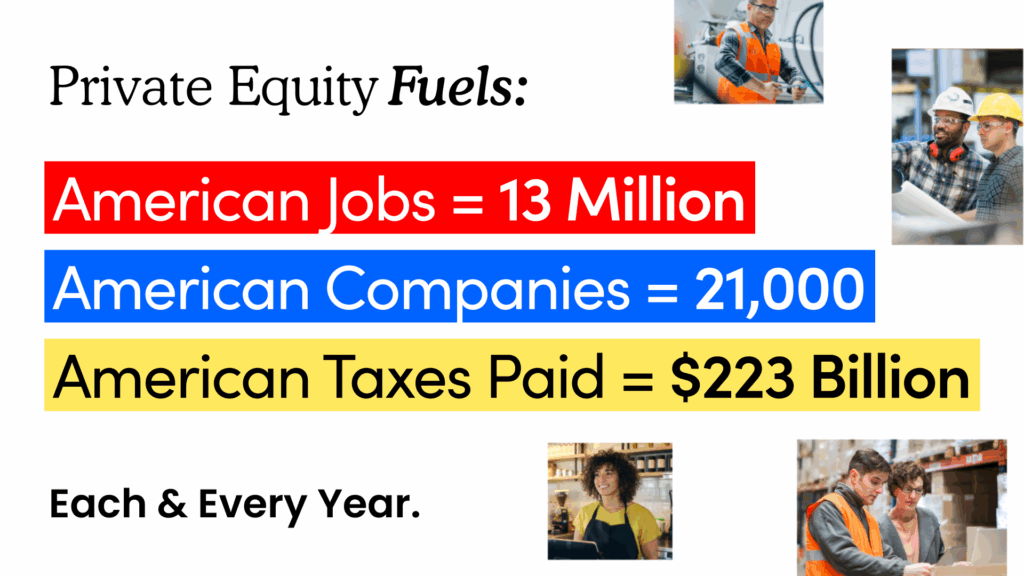

Private investment also helps American workers and families build wealth through job creation and expanded financial opportunities. In 2024, the private equity industry directly employed 13.3 million workers, up from 12 million in 2022. Employees at private equity–backed companies earned an average of $85,000 in wages and benefits.

In 2025, AIC released a video highlighting AIC member The Riverside Company’s investment in PFB Corporation, demonstrating how private equity empowers employees through shared ownership and supports stronger local communities.

AIC’s private credit report also highlighted the role private credit plays in expanding job opportunities and fueling U.S. manufacturing. In 2024, companies receiving private credit investments directly employed more than 811,000 workers. Private credit financing continues to modernize domestic manufacturing by funding advanced machinery and equipment while supporting more than 200,000 manufacturing jobs.

Investing In Local Communities

Private equity and private credit investments play a vital role in strengthening local economies across the United States. AIC’s report, “Investing Across America: Private Equity Fueling American Growth,” provided detailed data on private investment, jobs, businesses, and returns by state and congressional district, equipping policymakers with a clear picture of the industry’s impact on their constituents.

Private credit also drives significant economic activity nationwide, with private credit providers and related consumer spending generating more than $200 billion in GDP and supporting an additional 1.7 million jobs in 2024.

This year, AIC sponsored numerous in-district and Washington, D.C.–based events with members of Congress to highlight the industry’s economic contributions. These included a Punchbowl News–hosted event in Washington with Rep. August Pfluger (R-TX-11)focused on private equity’s role in strengthening U.S. energy production and small businesses. In October, AIC and Punchbowl News hosted an event on the road in South Bend, IN, with Rep. Rudy Yakym (R-IN-02) that highlighted private investment’s support for manufacturers, workers, and entrepreneurs.

In September, AIC also partnered with Roll Call to host a food truck event in Washington, D.C., that shared the story of how private investment enables small businesses like Van Leeuwen and Little Sesame to innovate, grow, and scale.

Growing Our Team

AIC also bolstered our experienced leadership team with several new hires in key roles. Will Dunham was announced as AIC’s new President and CEO AIC also welcomed Chris Toppings and Lee Slater as Co-Heads of Government Affairs, leading bipartisan advocacy efforts. Additionally, Caitlin Carroll joined AIC as Senior Vice President of Public Affairs, playing a pivotal role in advancing AIC’s communications efforts.

Looking Ahead to 2026

As AIC looks ahead to 2026, we remain focused on creating value for our members and advancing policies that support long-term private investment, economic growth, and retirement security for millions of Americans.